What are you actually juggling?

Debt doesn’t always show up in obvious ways. Sometimes it’s a handful of monthly payments you’ve gotten used to. Other times, it’s that lingering balance you’ve been meaning to tackle.

Before you can simplify your finances, it helps to really see what you’re working with. Take a second to think about what you're carrying.

Take our quick 5 question quiz to see how your debt might be affecting your wellbeing, and what to do about it.

.png?width=300&height=150&name=DEBT%20HAPPENS.%20Campaign%20(2).png)

DEBT HAPPENS.

Because adulting is expensive.

DEBT HAPPENS.

Because "new year, new activity" doesn't have to break the budget.

DEBT HAPPENS.

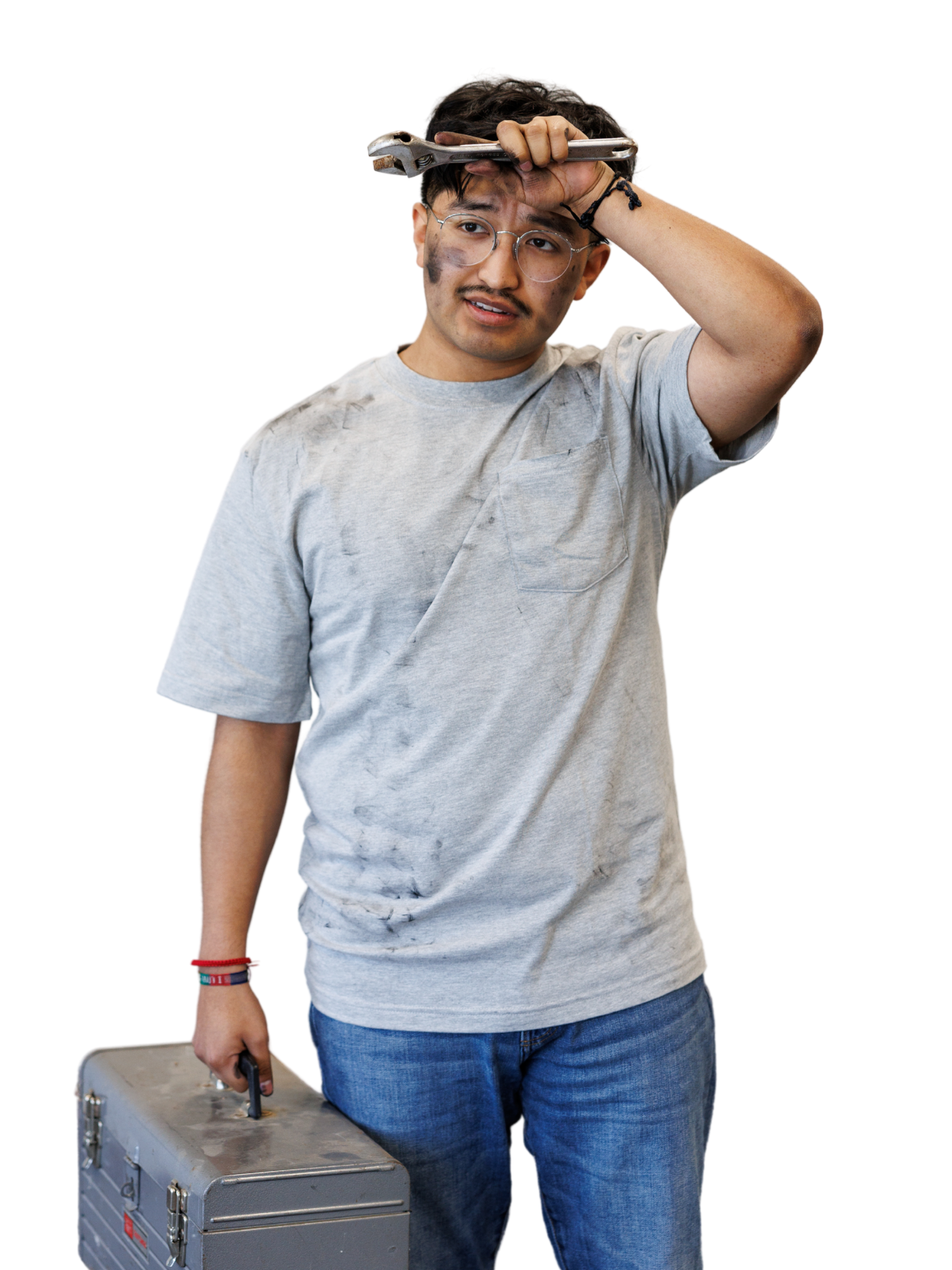

Because this year, we'll be prepared for our car's midlife crisis.

Real Relief. Tailored to You.

You don't need to have all the answers, that's our job. When you talk to our lending team, we don't just look at one loan or one credit card. We take a step back and look at your full financial picture and find ways to help you simplify, save and breathe easier. Here's what we do best:

- Review your debt picture and find patterns or possibilities you may not see on your own

- Consolidate and restructure your debt into one manageable monthly payment

- Reduce your interest rates and uncover hidden savings

- Use home equity, personal loans, or tailored options

- Get expert advice from someone who actually listens

- Walk away with clarity, confidence, and breathing room

It's not a one-size-fits-all solution. It's about looking at the puzzle pieces you've been juggling and helping you fit them together in a way that actually works for you.

You're not alone — and you're not stuck.

"We were so overwhelmed by debt, we didn't know where to start. Envista helped us save $200* a month and tons in interest, by consolidating."

-Leah & Joseph, Empowered Envista Members

"I never dreamt I could accomplish a remodel and paying off my debt with just one single loan payment – but Envista solved that puzzle for me."

-Tammy, Empowered Envista Member

.png?width=1200&length=1200&name=Debt%20Consolidation%20Social%20Media%20(8).png)

"I needed help getting rid of some credit card debt. Marna helped me pick the best option. It really helped me out a lot! Turned my $250 a month credit card interest payment into $110 a month that actually pays down my debt."*

-Benjiman, Empowered Envista Member

Quick Self-Assessment:

Where do you stand with credit?

Select all statements that apply to you.

1. Understanding Your Credit

2. Establishing Credit

3. Managing and Maintaining Credit

4. Improving Credit

How Did You Score?

Your score: 0 out of 16

Envista's lending team is here to help you achieve your financial goals. Schedule a consultation today to discuss personalized solutions for your unique situation.

When Life Adds Up: Why Debt Consolidation Matters Now More Than Ever

For many of us, debt doesn't come from a single, dramatic moment. It's not about overspending or making reckless choices. It's about life. It's about managing a household, supporting your family, or just trying to keep up.

The Truth About Debt Relief Programs: What You Need to Know Before You Sign

At Envista, we believe in helping our members make informed financial decisions. That's why we want to break down how debt relief programs really work, and why there may be better options available that protect your credit and your financial future.

Why Your Credit Score Matters (And What It Means for Your Financial Future)

Your credit score plays a crucial role in securing loans, setting interest rates, and determining credit limits. Learn how lenders use your credit score, and how to boost it to unlock better financial opportunities.

*Individual results may vary. All loans subject to credit approval. Actual rate and payment will depend on your credit profile, loan amount, term, and repayment method. Testimonials reflect the personal experience of individual members and do not guarantee future performance or savings. Envista does not offer or endorse debt relief settlement programs. Federally insured by NCUA.

-1.png?width=2000&height=912&name=DEBT%20HAPPENS-%20Campaign%20(1)-1.png)

-1.png?width=375&height=171&name=DEBT%20HAPPENS-%20Campaign%20(1)-1.png)